If you work in employee benefits—or you’re just trying to make sense of how pharmacy benefits managers (PBMs) work—you’ve probably run into your fair share of head-spinning diagrams.

But one chart, created by a North Carolina physician and published in the Journal of Clinical Oncology, cuts through the noise. It lays out the PBM money flow in a way that’s clear, concise, and actionable.

Let’s walk through it step by step, so you can understand it well enough to draw it on a napkin and explain it to anyone in plain English.

Who Are the Players?

There are seven key players in the PBM ecosystem:

Plan Sponsor (the employer)

Health Plan

PBM (Pharmacy Benefit Manager)

Drug Manufacturer

Wholesaler

Pharmacy

Patient

Step One: Follow the Money

This is where it all begins—and yes, it’s complex, but stay with us.

The money starts with the Plan Sponsor (the employer). The golden rule: He or she who has the gold makes the rules. The plan sponsor funds the entire ecosystem.

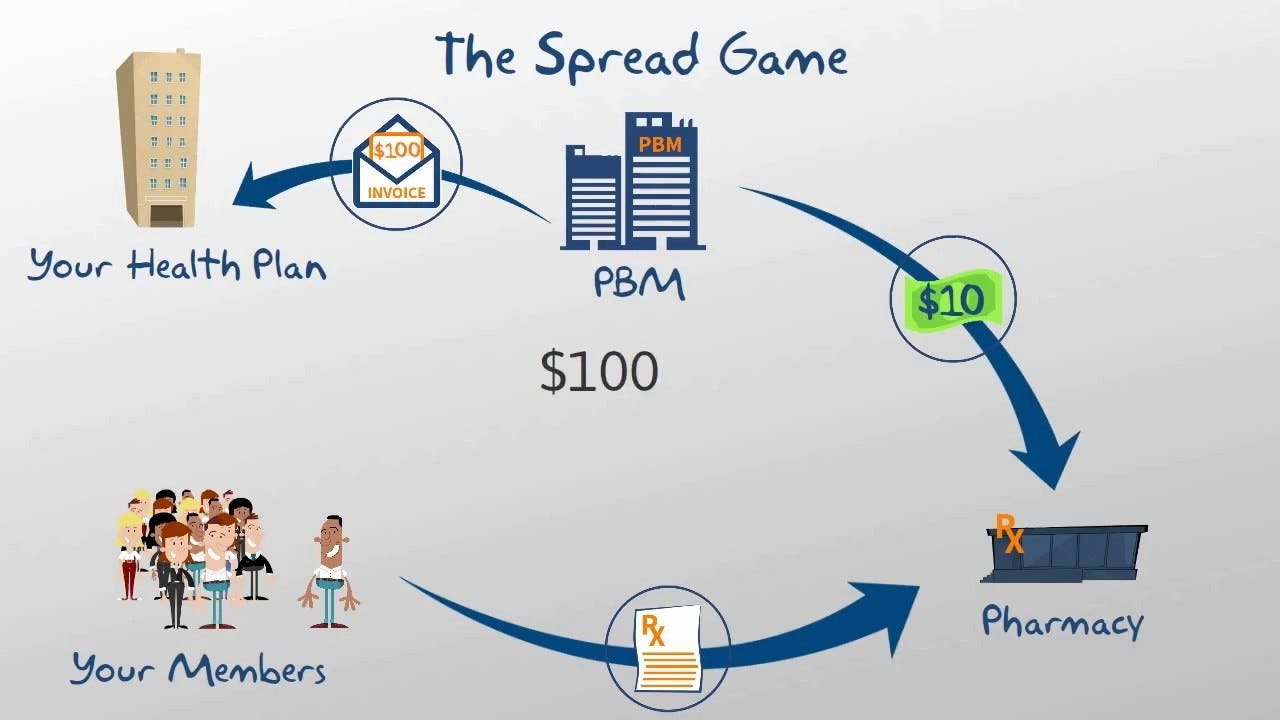

That money is passed to the Health Plan, which then pays the PBM.

The PBM pays the Pharmacy to fill the prescription.

The Pharmacy pays the Wholesaler for the medication.

The Wholesaler pays the Drug Manufacturer, who actually made the drug.

So the money flows like this: Plan Sponsor → Health Plan → PBM → Pharmacy → Wholesaler → Drug Manufacturer.

Step Two: Follow the Drugs

The Drug Manufacturer makes the drug.

It is distributed to the Wholesaler.

The Pharmacy receives it.

The Patient picks it up.

So the drugs flow like this: Manufacturer → Wholesaler → Pharmacy → Patient.

The Arrows You Can’t See: Services & Rebates

Let’s look at the services (dotted arrows) and hidden money flows that make this so murky.

The Plan Sponsor pays the PBM, but they also receive rebates from the PBM. In theory, this rebate-sharing offsets costs—but it often raises more questions than answers.

The PBM performs services for both the Health Plan and the Drug Manufacturer—making both of them "customers."

The Drug Manufacturer pays the PBM for formulary placement (getting their drug on the PBM’s preferred list). This payment is often called a rebate, but it can also include:

Formulary fees

Market share payments

Bonus incentives

Here's the catch: Not all of these payments are passed through to the employer. PBMs often keep 20% to 45% of these funds, making this a key area where opacity creeps in.

Who Really Has the Power?

Unfortunately, not the employer—or the pharmacy—or even the patient.

Only three wholesalers dominate the U.S. market: McKesson, Cardinal, and AmerisourceBergen.

Three PBMs control 85% of the PBM market: CVS Caremark, Express Scripts (Cigna), and OptumRx.

Many drugs, especially specialty medications, are protected by patents, so there's often only one manufacturer.

That means limited choices across the board.

Why Specialty Pharmacy Is the Real Battleground

Here’s where it gets serious: 73% of total Rx spend is on specialty medications—including injectables, cancer pills, HIV medications, and other biologics.

These drugs are expensive, often costing tens of thousands per month. That’s why co-pay assistance programs exist—direct lines from Drug Manufacturers to Patients, helping subsidize costs that would otherwise be unaffordable.

But even with copay assistance, patients still pay premiums (often via payroll deductions) to the health plan, which theoretically buys them pharmacy benefits. In return, they get medication coverage—but how much they pay out-of-pocket can vary wildly depending on the plan design.

So What Should Employers Do?

Here’s the million-dollar question: Should you use a transparent pass-through PBM? Should you carve out specialty pharmacy to a separate PBM?

The PBM industry is split:

PBMs like OptumRx argue carve-outs are bad for plan integrity and coordination.

Drug makers like Pfizer argue carve-outs are essential for cost control and transparency.

What’s clear is this: Employers have a fiduciary duty to understand and manage these contracts. And that starts with knowing who’s getting paid, how much, and for what.

Bottom Line: Learn This Chart Cold

If you're in employee benefits, this isn't just academic. Understanding this money and drug flow is critical to making smarter purchasing decisions—and avoiding being taken for a ride.

You don’t have to be a pharmacist or economist. But you do have to be able to sketch this flow on a napkin and explain it in plain English.

Because once you understand how the PBM game is played, you can finally start to change the rules.